As I have argued in past coverage of QuantumScape, the company remains vague about when exactly this will happen. The company first needs to fully get to the production stage. However, don’t assume this means a short path back to higher price levels for QS. As one of the world’s largest automakers, being its exclusive provider of these batteries would certainly mean billions in annual revenue. Sure, you may think that just having Volkswagen as a buyer of its SSBs is enough to drive a big QS stock comeback. At worst, Volkswagen could end up being its only major customer.Ī Short Path to Higher Prices? Not So Fast Still, even if it reaches the production stage, at best QuantumScape will sign up just Volkswagen as a buyer, and possibly some automakers evaluating its samples. Other automakers are also evaluating the company’s samples. QS still has a strategic partnership with Volkswagen (OTCMKTS: VWAGY).

Of course, that doesn’t mean QuantumScape will be left out in the cold if this happens.

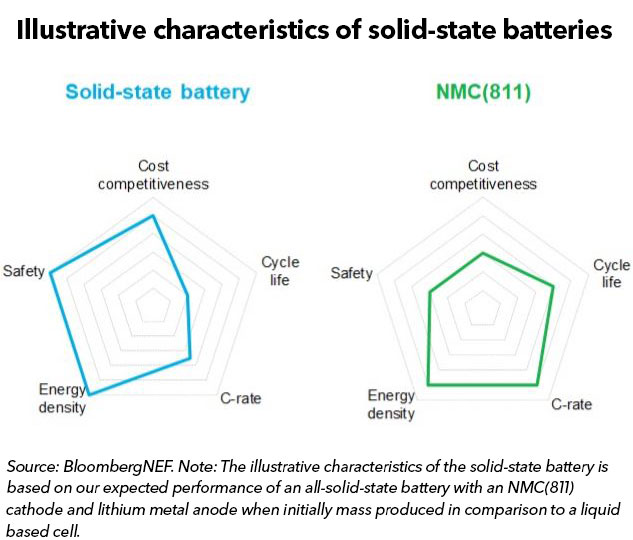

Other automakers may follow Toyota’s lead, and decide to go the in-house route in lieu of partnering up with this company. The fact the Japan-based automaker has opted to develop its own SSBs shows that, even if QuantumScape brings one to market, it’s not as if the company will be the sole player in the space. QuantumScape shares have moved higher on the Toyota news, due to the view that Toyota’s decision to pivot toward SSB-powered EV is a sign that these types of batteries (argued to be safer, faster to charge, and more efficient) are viable on a large-scale.īut while Toyota’s decision may underscore that SSBs batteries are scalable, don’t assume this translates into big upside ahead for QS stock.

0 kommentar(er)

0 kommentar(er)